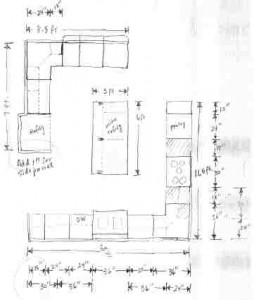

During the design phase of the houseplans, the kitchen is always my domain. I pull out my grid paper, mechanical pencils, and, using standard cabinet sizes, draw out my plan. This takes many iterations and, even now, is subject to change.

I’m very flexible about particular cabinet sizes, depending on what I can buy for a very good price. As many people will do when beginning a project like this, I took my initial kitchen dimensions and started with booklets picked up for free from Home Depot. I think people have the idea that buying cabinets from Home Depot will be less expensive than buying them from a custom cabinet installer. I have to say that I am very skeptical that this is a good assumption, after my research. Looking at the cost of cabinets available from the “Ready to Assemble” (RTA) places indicates that there is a generous profit margin between materials cost and delivered, assembled cabinet prices.

Once I had my initial plan put together, I then called the Home Depot cabinet help line and got an actual quote for the cost of the cabinets. In my discussions with the very helpful lady on their cabinet design helpline, I learned that Kraftmaid (which I assumed was a less expensive line) was one of the most expensive… right up there with their Thomasville line. To my surprise, she informed me that the Martha Stewart line was one of the more affordable lines. I also learned that the Hampton Bay cabinets that are offered on their site, are not part of their design services (if you order those, you are on your own!).

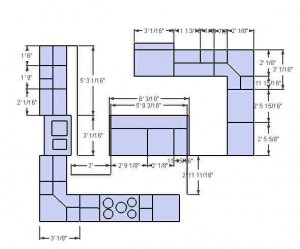

Oh, my gosh! They were so very expensive compared to what I thought was a reasonable price. After choosing one of the least expensive designs on the Martha Stewart line, I submitted my plans by email to the lady at the helpline. It took nearly 2 weeks to get a quote back. The quotation (for kitchen cabinets alone — not any bath or laundry cabinetry) was $16,242, not including sales tax or shipping.

I quickly became very motivated to seek out other sources. I discovered something called RTA cabinets (ready-to-assemble). There are many websites that offer discounted cabinets in this form. The main difference it that, as the name implies, you have to assemble the cabinets from the components after they are delivered to you. You can still choose the type of materials, hinges, panels, drawer style, etc. that you would expect from any other cabinet source. Other than the fact that you had to do your own assembly, however, I cannot see much difference between this and the cabinets sold by Home Depot. For the additional work involved in assembling the cabinets yourself, you can save a really huge amount. Not only will many of the sites offer you free shipping for larger orders, but you pay no sales tax because it was purchased out of state.

Taking it one step further, if you are willing to choose cabinets from the selection of cabinets that are on clearance, you can save even more.

One of my favorite sites (so far) is cabinetgiant.com. For example, at their site, if you choose a “closeout” cabinet design, you’ll save over 50% off most of the cabinets compared to their regular price (which is already much less than Home Depot’s comparable assembled products). Choosing a style called Brindleton Maple, which is not on closeout, using my kitchen plan with upper and lower cabinets, crown molding, and all the finishing materials, my estimated total came to only $6,910.

Using closeout cabinets in their Antique White style for Bathrooms and Laundry Room cabinets, the total came to only $2,112. Now, granted, I had to modify my design slightly when certain sizes were not available in the closeout pattern. But for less than half the price at Home Depot, I’d say the extra time is well worth it.

We are not yet to the point where I can push the button and order these cabinets, and the current closeout stock will most likely be depleted by the time we are ready for cabinet ordering. However, this exercise in estimating the expected cost and exploring the possibilities will serve us well when the time comes.

So, although I realize this isn’t for everyone… if you are pretty handy with assembling things using simple tools, and if you are building a homestead, or even just planning to remodel a kitchen or bath, consider ordering ready-to-assemble cabinets and save yourself some big bucks.

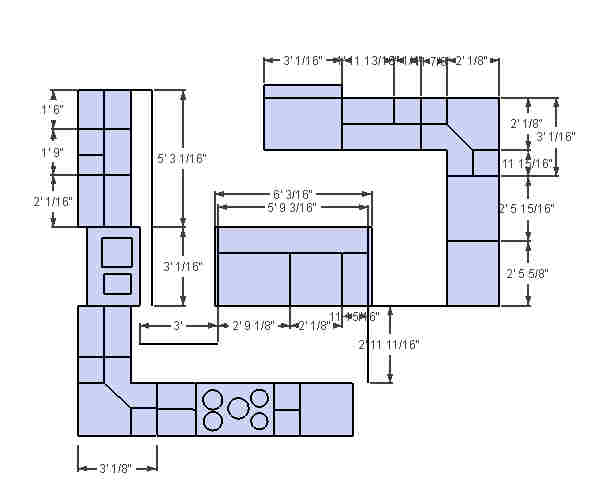

Postscript: After Patty’s suggestion, I got started learning SketchUp. I still have a long way to go, but here is a first draft at a new kitchen plan (plan view):

Google’s SketchUp is very nice, free to use and offers some nice tutorials. If you are interested in downloading it, you can find it here: